REGENEXBIO INC.

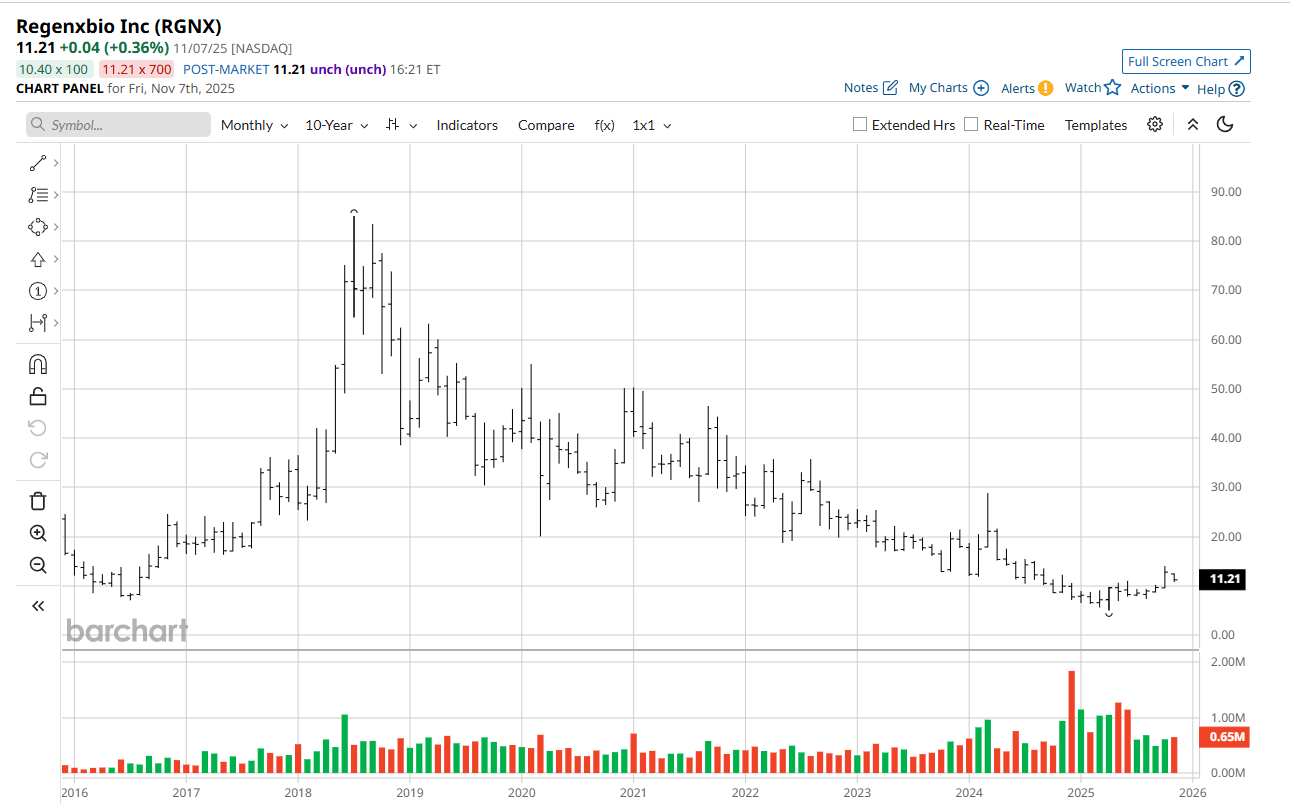

Another biotech breakout

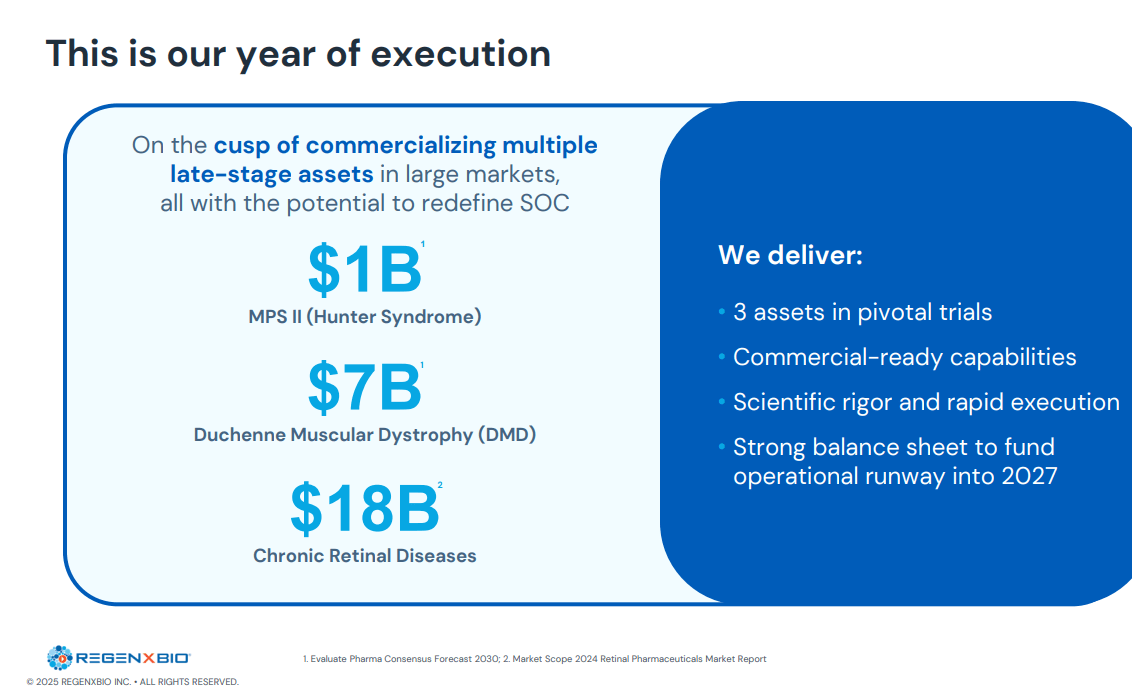

RGNX $ 11.21 $566M Market Cap Enterprise Value approximately $ 288 M

Cash on hand end of Sept $302 M

Wallstreet’s 12-month avg price Target $ 28

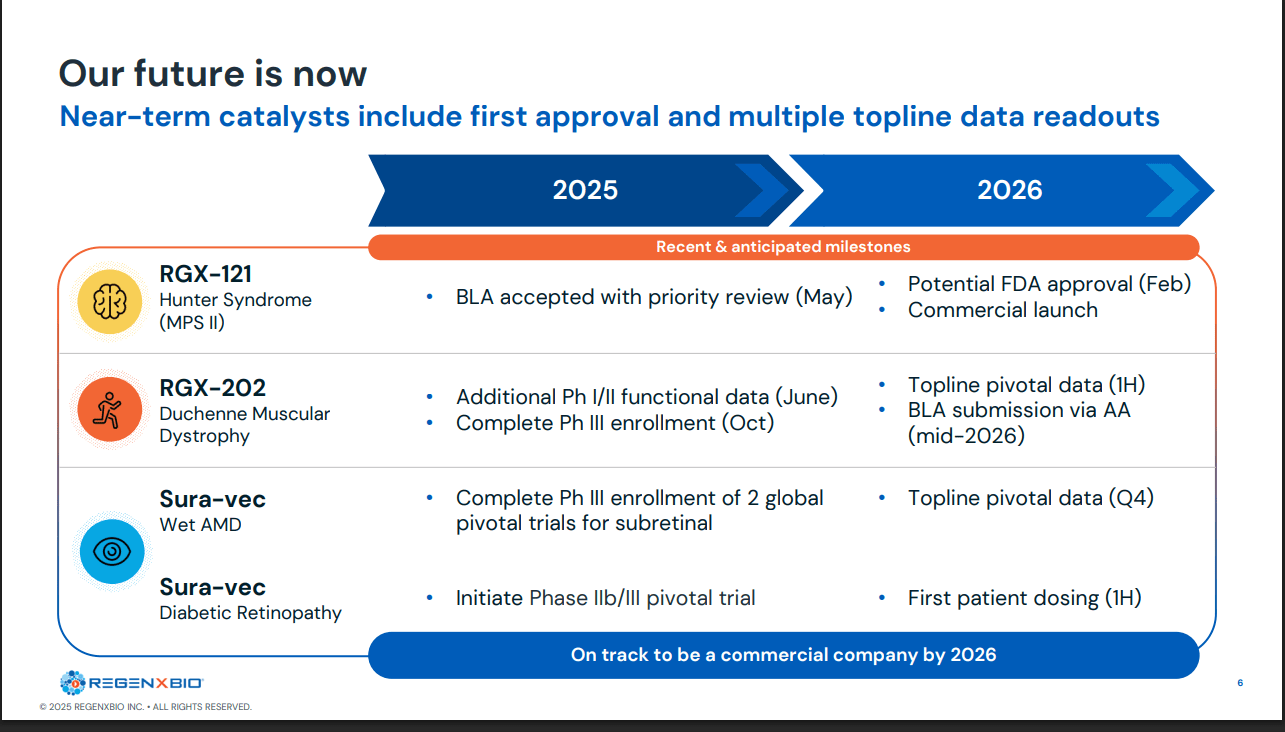

RGNX is moving forward after 10 long years of persistence. Year to date the XBI biotech index is beating the Mag 7. Gravy Train has been on top of this trend over the past twelve months.

Provided below is a detailed description of ABBV’s potential $ 1.78 bn commitment to the RGNX platform, ten-year chart and the recent investor presentation. I have highlighted key slides.

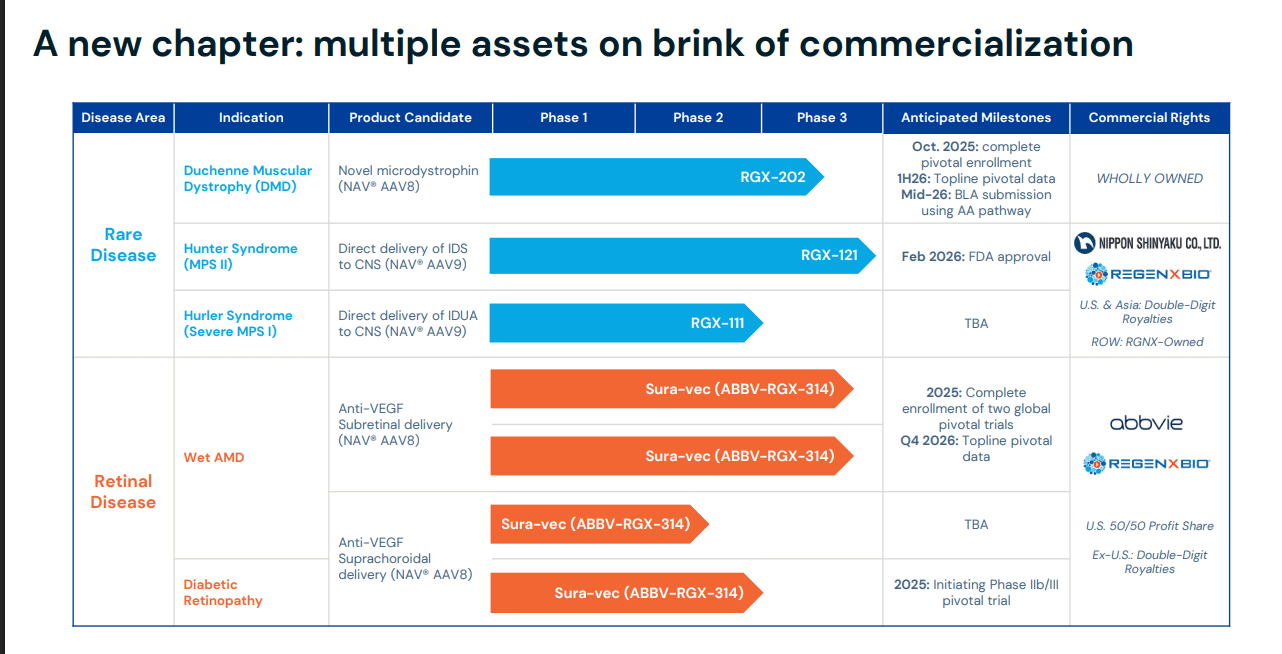

What is RNGX? REGENXBIO is a biotechnology company on a mission to improve lives through the curative potential of gene therapy. Since its founding in 2009, REGENXBIO has pioneered the field of AAV gene therapy. REGENXBIO is advancing a late-stage pipeline of one-time treatments for rare and retinal diseases, including RGX-202 for the treatment of Duchenne; clemidsogene lanparvovec (RGX-121) for the treatment of MPS II and RGX-111 for the treatment of MPS I, both in partnership with Nippon Shinyaku; and surabgene lomparvovec (ABBV-RGX-314) for the treatment of wet AMD and diabetic retinopathy, in collaboration with AbbVie. Thousands of patients have been treated with REGENXBIO’s AAV platform, including those receiving Novartis’ ZOLGENSMA®. REGENXBIO’s investigational gene therapies have the potential to change the way healthcare is delivered for millions of people. For more information, please visit www.REGENXBIO.com.

Thesis: Potential catch up phase for emerging Biotech after 10 years of R&D, the fed now lowering rates, large continued short interest and an FDA that wants to solve health problems. All the while, the Chinese have made significant progress in drug discovery and the current administration is looking for ways to catch-up. See Below Chinese Biotech Industry and the FDA’s Dr. Marty Makary’s comments on drug discovery. RGNX is the verge of a potential sea change of fundamental developments.

RGNX Investors presentation: https://regenxbio.gcs-web.com/static-files/a7f4f464-cba3-412b-88b1-02de8bf70faf

Bottom Line: RGNX has a major partner that could be willing to share up to $ 1.7 billion for half the Revenue and profits 314 related products alone…. market cap is $ 566 million.

China’s biotech industry is on the rise. Will it reshape US …

https://cen.acs.org › drug-development › web › 2025/09

Sep 5, 2025 — Corporate alliances are being inked against the backdrop of increasing geopolitical tensions between China and U.S.

Makary says he wants nimbler FDA, calls for new drug …

Regulatory Affairs Professionals Society | RAPS

https://www.raps.org › news-and-articles › news-articles

Jun 16, 2025 — Marty Makary, commissioner of the US Food and Drug Administration (FDA), said he wants the agency to become nimbler in the next five years.

KEY Slides !!

ABBV collaboration is something that should be highlighted….

AbbVie and REGENXBIO Inc. partnered in September 2021 to develop and commercialize a gene therapy called RGX-314. Under the terms of the agreement, AbbVie paid REGENXBIO a $370 million upfront payment. REGENXBIO is also eligible to receive up to $1.38 billion in additional milestone payments related to development, regulatory, and commercial achievements. The total potential deal value is up to $1.75 billion.

Key details of the collaboration:

-

Upfront Payment: AbbVie made an initial payment of $370 million.

-

Potential Milestone Payments: REGENXBIO could receive up to $1.38 billion in additional payments based on specified milestones.

-

Profit Sharing: The two companies will share profits equally from net sales of RGX-314 in the U.S.

-

Manufacturing: REGENXBIO leads manufacturing for clinical development and U.S. commercial supply, while AbbVie handles manufacturing for commercial supply outside the U.S.

-

Amendments: In August 2025, the companies amended their agreement to modify diabetic retinopathy development plans, with AbbVie committing an additional $200 million for trials.