Fry Guy

It may be time to get your feet wet

“Fridea”

Sittin’ in the mornin’ sun

I’ll be sittin’ when the evenin’ come

Watching the freinds roll in

And then I watch ‘em roll away again, yeah

I’m sittin’ on the deck of the pool

Watching the cover roll away

I’m just sittin’ on the deck of the pool

not Wastin’ time.

I left my home in Georgia

Headed for the ‘Fiberglass pool

I’ve had nothing to live for

Looks like less maintenance come my way

So I’m just gonna sit on the deck of the pool.

Watching the cover roll away

I’m sittin’ on the dock of the bay

not Wastin’ time

Look like pool maintenance gonna change

Everything still remains the same

I can do what ten people used to do

So I guess I’ll choose the Latham name, yes

Sittin’ here resting my bones

And this ease of maintenance won’t leave me alone

It’s twenty thousand cheaper so I roamed

Just to make this pool my home

Now, I’m just gonna sit at the deck of the pool

Watching the cover roll away

Sittin’ on the deck of the pool

Not Wastin’ dimes.

Symbol SWIM ($7.49) MKT Cap: $ 900,000,000. Enterprise Value $1.21 billion.

https://www.lathampool.com/fiberglass-pools/

About: Latham Group, Inc., headquartered in Latham, NY, is the largest designer, manufacturer and marketer of in-ground residential swimming pools in North America, Australia and New Zealand. Latham has a coast-to-coast operations platform consisting of approximately 2,000 employees across over 30 locations. With an operating history that spans over 65 years, the Company offers the industry’s broadest portfolio of pools and related products, including in-ground swimming pools, pool liners and pool covers. Latham holds the #1 market position in North America in every product category in which it competes. Latham, INC.

And its family of brands, including Latham, the Pool Company, Coverstar, GLI and Narellan and Radiant. Servicing North America, Australia and New Zealand.

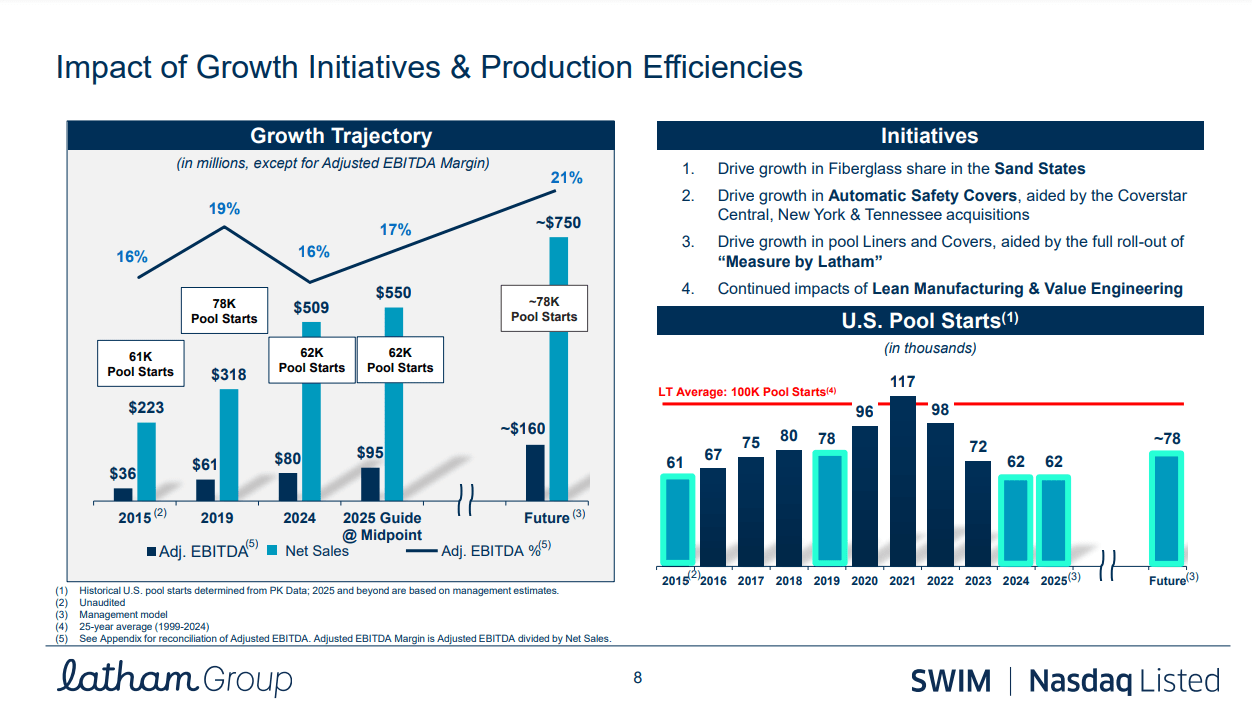

Thesis: Latham has improved all aspects of their unique business in the headwind of a bear market for pool building. When the housing/pool market recovers Latham is in a position to benefit from a return to Pool Starts that averaged 100k per year from 62k at present. Market share gains and profitability should provide a solid upside to street estimates and free cash flow. Straight forward thesis similar to TREX and AZEK durability, price, time to install and beauty are all reason for SWIM to gain share.

Best slide in company investor deck.

Bottom Line: A Pool building recovery would lead to meaningful improvement in operation metrics. The company is expanding into the Sand States and expanding its dealer base. So: Better, Faster, Beauty, Durability and Operation Metric’s add up to winning formula for a winning formula.

RIsk: There is no housing recovery, recession, debt, limited success in Sand States and weather constraints.

NEWSLETTER DISCLAIMER

The Stock Pawnshop newsletter (“Newsletter”) should not be construed as investment advice. The Newsletter is for entertainment purposes only. Antimony Isle, LLC, its owners or affiliates, do not make any representations or warranties, express or implied, about the Newsletter’s accuracy, completeness, or correctness. The information in the Newsletter may become outdated and there is no obligation to update any such information. The information contained in the Newsletter is not intended to constitute legal, accounting or tax advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in the Newsletter may not be suitable for you. This Newsletter should not be construed as a solicitation to act as securities broker or dealer. Antimony Isle, LLC and its owners and affiliates may hold or acquire securities covered in this Newsletter and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this Newsletter, without notice.